The Great Trade Shift: How $14 Trillion in Global Commerce is Finding New Routes

A Regional Perspective on the Biggest Trade Transformation in Decades

The global trade system is experiencing its most significant reorganization since World War II. By 2035, over $14 trillion worth of trade—nearly one-third of all global commerce—could shift from one corridor to another. For business leaders, understanding which regional trade routes will thrive and which will struggle has become essential for strategic planning.

The Three Futures of Global Trade

Our analysis reveals three potential scenarios that could reshape $45 trillion in projected 2035 global trade:

- Baseline Growth: Trade expands by $12 trillion following current patterns

- Diversification: Companies seek supply chain resilience, reducing growth by $1 trillion

- Fragmentation: Geopolitical tensions escalate, erasing $3 trillion in potential growth

The stakes are massive, but the real story emerges when we examine specific regional corridors.

Regional Winners and Losers: A Strategic Map

The Safe Bets: Corridors That Win in Any Scenario

India's Moment Has Arrived Every major trade corridor involving India—whether with Europe, the United States, China, or the Middle East—shows robust growth across all scenarios. India-EU trade could see some of the fastest expansion globally, driven by India's economic growth and complementary trade relationships. Smart businesses are already positioning themselves: European companies are establishing manufacturing bases in India, while Indian firms are expanding their presence in Western markets.

The China-Emerging Markets Alliance Despite global tensions, trade between China and emerging economies (ASEAN, Middle East, Africa) accelerates even in a fragmentation scenario. China-ASEAN trade has already reached the point where each is the other's largest trading partner. This isn't just about geography—it's about complementary economies. ASEAN provides both markets for Chinese goods and integration into Chinese value chains, while the Middle East offers energy resources China needs and markets for its manufactured goods.

This is where a new port in Vietnam could become a serious option to consider. Real numbers show that this is a scenario picking up pace and may be the most likely. Currently, developing a port for use or investment in Vietnam may be the connection needed between ASEAN partners as well as the Middle East, like Qatar. We have two opportunities for those looking to take the leap and capture future gains in this sector early. Delta Nova Maritime Hub offers unlimited potential for development in Ho Chi Minh, Vietnam.

Advanced Economy Solidarity When tensions rise, old friends stick together. Europe-US trade strengthens in fragmentation scenarios, with European manufacturing potentially replacing Chinese imports to America. The Europe-Japan corridor shows similar resilience. These aren't just political alliances—they represent deep economic complementarities and shared regulatory standards that make trade substitution feasible.

The Cautious Middle Ground

Europe's Emerging Market Play European trade with Latin America, Africa, and the Middle East represents moderate but steady growth. The recently signed EU-Mercosur agreement and ongoing negotiations with ASEAN signal Europe's commitment to these corridors. However, growth here depends on emerging market stability and China's competitive response. European businesses should prepare for both opportunities and competition.

The ASEAN Advantage Southeast Asian nations occupy a unique position—close enough to China to benefit from its growth, yet diverse enough to serve as alternatives for Western companies. ASEAN-US trade has surged as companies seek China alternatives, but interestingly, ASEAN-China trade has grown simultaneously. This dual growth pattern makes ASEAN the ultimate hedge in an uncertain world.

The Danger Zones

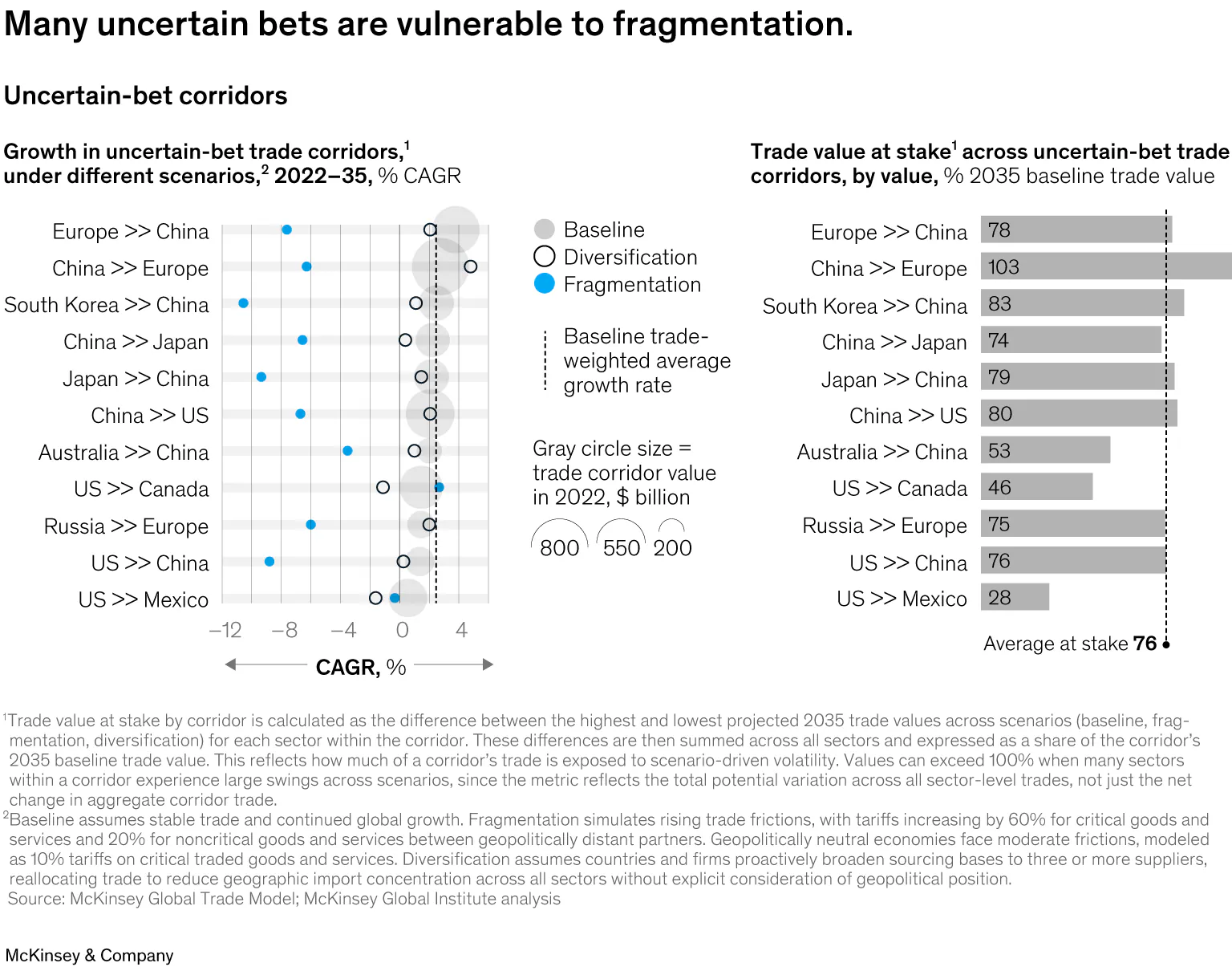

China-West Decoupling The corridors between China and advanced economies (US, Europe, Japan) face the steepest potential declines. In a fragmentation scenario, these could shrink by an average of 5.8% annually. Already, China's share of US imports has dropped from 24% to 15% since 2018. However, this headline number masks complexity—much China-US trade now flows through third countries, maintaining value-added connections even as direct trade falls.

The North American Paradox Surprisingly, US-Canada and US-Mexico corridors appear in the "uncertain" category—not due to geopolitical tensions but because of extreme concentration. With the US accounting for 80% of Canadian and Mexican manufactured exports, these corridors are vulnerable to diversification efforts despite their geographic and political proximity.

McKinsey has an interesting take on the different scenarios that may take place.